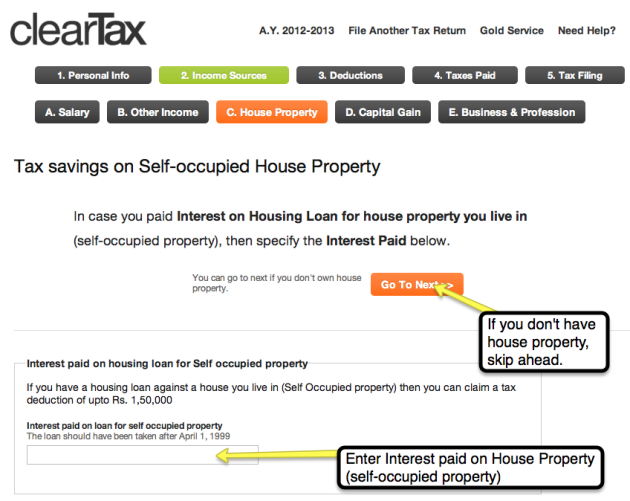

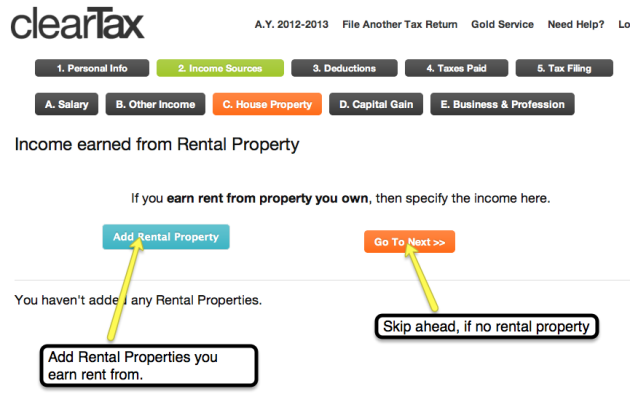

8. Similarly, if you have a Rental Property from which you earn Rent, you can add this information. Skip ahead if you don't own a rental property.

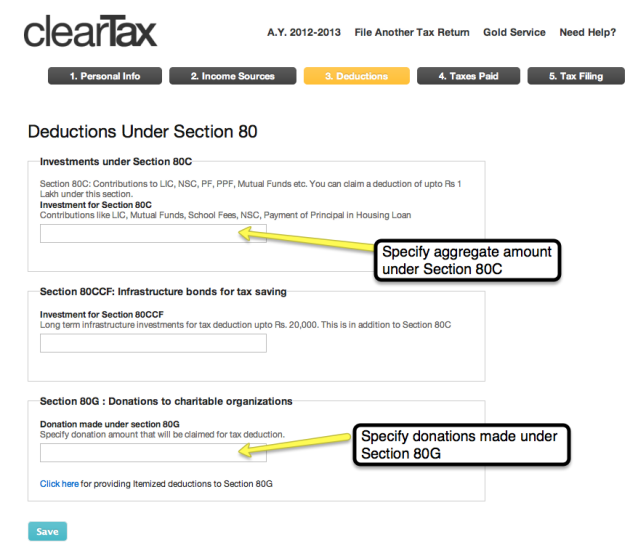

9. Deductions Under Section 80: Specify total amount invested in Section 80C. This can include payments for LIC, PPF, NSC etc. Also school fees for children. You can claim the principal amount of your housing loan. The limit is Rs. 1 Lakh. You can declare your charitable donations which are tax deductible under Section 80G.

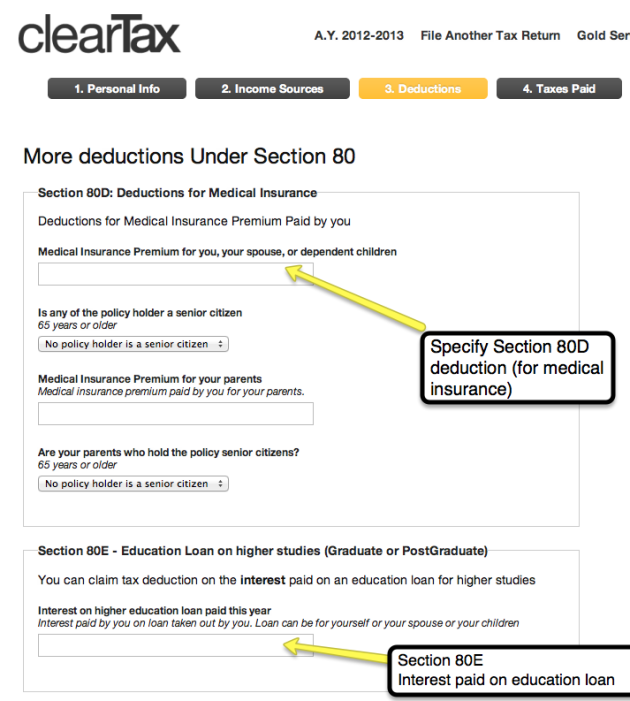

10. More Deductions Under Section 80: You can specify other deductions such as Section 80D (For medical insurance), Section 80E (For Interest paid on education loan), Section 80DD, Section 80U, Section 80CCC, Section 80CCF, Section 80DDB, Section 80GG etc.

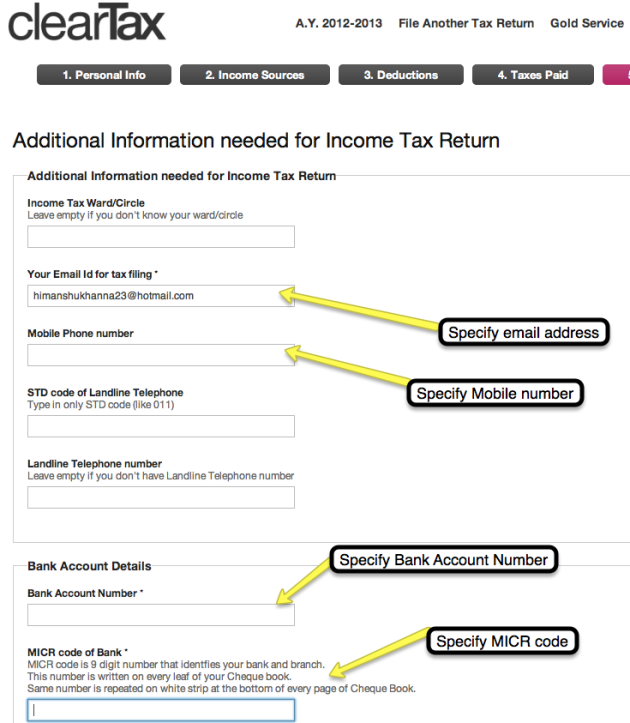

11. Bank Details for getting your Income Tax Refund: You need to specify your Bank Account number to the Income Tax Department. For this you need your Bank Account Number and your MICR code.

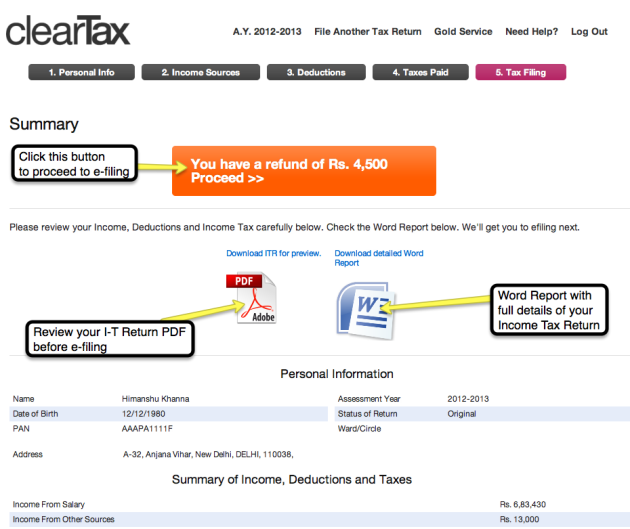

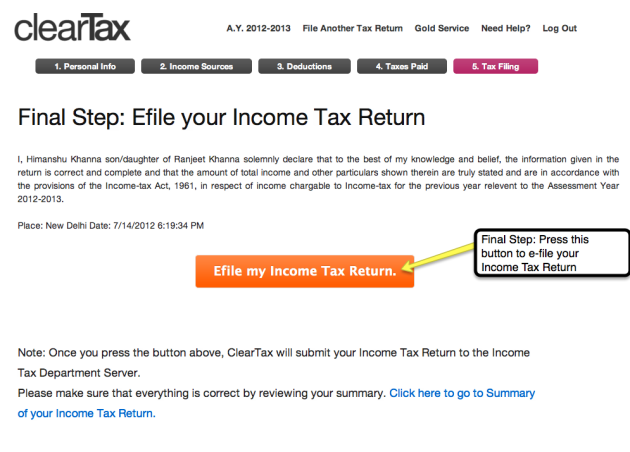

12. Review your Income Tax Return before filing: You should review your Income Tax Return by looking at the Word Report and the ITR PDF preview offered by ClearTax. Make sure everything is correct before actually e-filing your Income Tax Return.